Is a Jumbo Loan Right for You? Discover the Conveniences and Needs

Discovering the Advantages and Characteristics of Jumbo Loans for Your Next Home Acquisition Decision

As the genuine estate market advances, understanding the ins and outs of big car loans ends up being increasingly significant for prospective homebuyers thinking about high-value buildings. To fully appreciate exactly how jumbo fundings can influence your home purchase strategy, it is vital to discover their essential functions and advantages in higher detail.

What Is a Jumbo Financing?

Jumbo fundings are usually used by purchasers looking for to buy high-value homes or homes in pricey markets. jumbo loan. Offered the bigger amounts borrowed, lending institutions commonly enforce more stringent credit report demands, including greater credit history, reduced debt-to-income ratios, and bigger deposits. The rates of interest on jumbo financings may be a little more than those on adjusting fundings, reflecting the boosted threat for lending institutions

In addition, the approval procedure for a jumbo finance can be extra time-consuming and complex, as lenders require considerable documents to analyze the customer's economic stability. Comprehending these nuances is necessary for potential home owners thinking about a big finance for their building financing requirements.

Trick Benefits of Jumbo Lendings

One considerable advantage of jumbo fundings is their capacity to finance higher-priced properties that exceed adjusting funding limitations. This attribute makes them an attractive choice for buyers aiming to acquire luxury homes or homes in high-cost locations where prices typically surpass conventional finance limits.

Additionally, jumbo finances usually feature flexible terms and affordable rate of interest, enabling debtors to tailor their funding to match their one-of-a-kind economic situations. jumbo loan. This versatility can include options for adjustable-rate mortgages (ARMs) or fixed-rate lendings, supplying purchasers with the ability to manage their monthly settlements according to their preferences

An additional benefit is that jumbo car loans do not call for exclusive home loan insurance coverage (PMI), which can substantially reduce the total price of the loan. With PMI often being a significant expenditure for conventional financings with reduced deposits, avoiding it can result in significant savings over time.

In addition, consumers of big fundings usually have access to greater loan quantities, enabling them to buy buildings that fulfill their way of living needs. This accessibility empowers buyers to act emphatically in affordable realty markets, safeguarding their preferred homes better. Generally, big finances offer important benefits for those seeking to fund premium homes.

Qualification Demands for Jumbo Lendings

Jumbo finances come with certain eligibility demands that potential customers need to meet to safeguard financing for high-value residential properties. Unlike conventional finances, which have established restrictions based on the adhering finance limits developed by government-sponsored entities, big lendings exceed these thresholds, demanding stricter requirements.

Furthermore, jumbo fundings typically demand a substantial down settlement, commonly ranging from 10% to 20% of the acquisition rate, relying on the loan provider's policies and the debtor's financial situation. Cash books are also taken into consideration, with numerous loan providers expecting consumers to have a number of months' well worth of mortgage payments conveniently available. Last but not least, extensive documents of earnings and possessions will be needed to sustain the car loan application. Meeting these qualification needs can position debtors positively in safeguarding a jumbo funding for their wanted residential or commercial property.

Contrasting Jumbo Car Loans to Traditional Financings

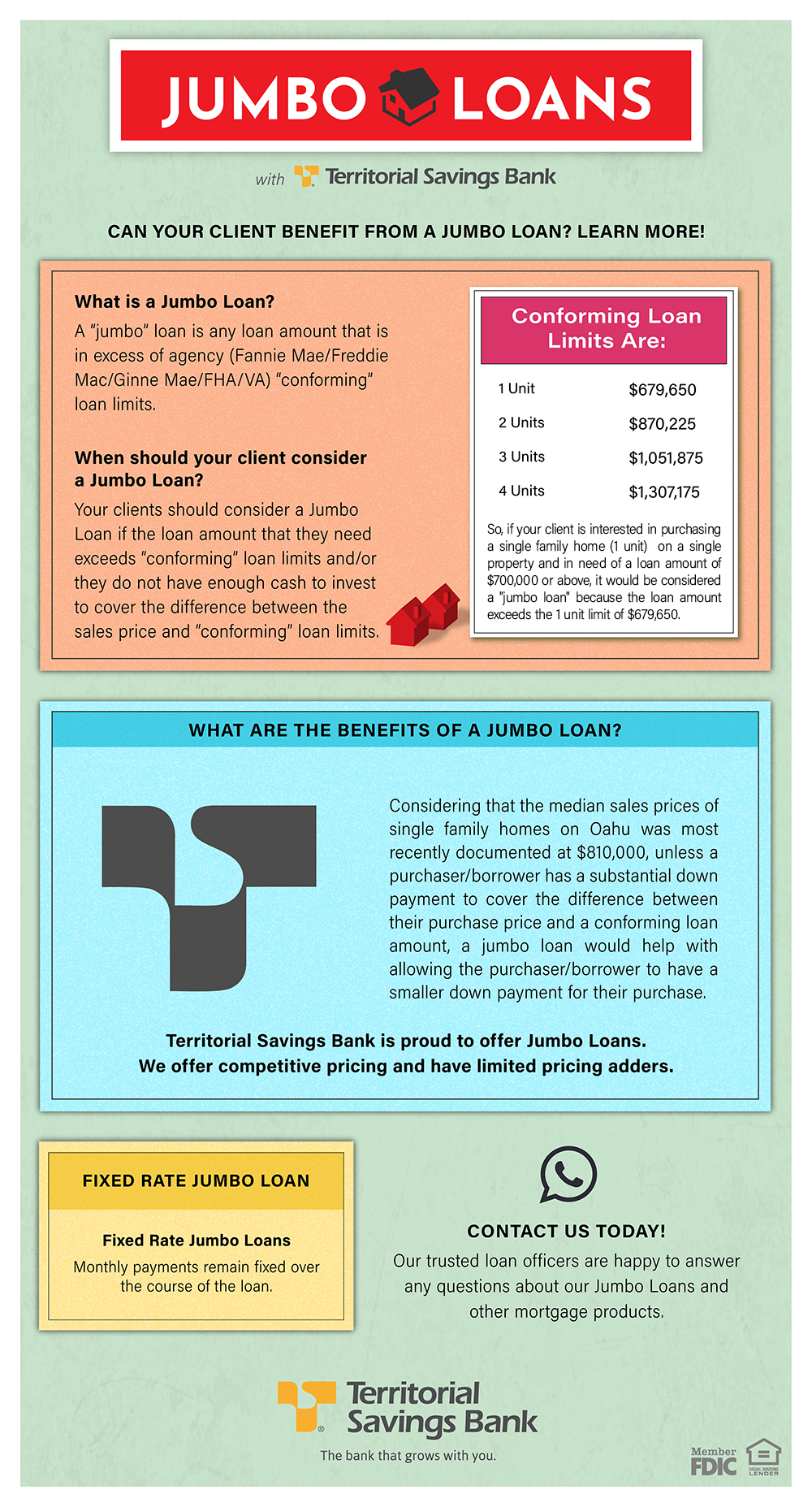

Recognizing the differences between conventional finances and jumbo lendings is important for homebuyers navigating the high-end property market. Jumbo fundings surpass the adhering financing limits set by the Federal Real Estate Money Company (FHFA), which indicates they are not eligible for acquisition by Fannie Mae or Freddie Mac. This leads to different underwriting criteria and requirements for borrowers.

On the other hand, conventional fundings normally follow these limits, enabling an extra structured approval process. Big loans usually call for stricter credit history, larger down repayments, and better monetary gets. While a traditional funding might call for a down payment of as little as 3% to 5%, big car loans generally necessitate a minimum of 10% to 20%.

Rate of interest on big car loans might vary from those of traditional car loans, commonly being slightly greater as a result of the boosted danger lending institutions presume - jumbo loan. The capacity for significant funding can be advantageous for buyers seeking deluxe residential or commercial properties. Eventually, comprehending these distinctions allows buyers to make informed decisions, aligning their financing choices with their special buying needs and financial circumstances

Tips for Protecting a Jumbo Funding

Securing a big lending requires mindful preparation and prep work, as lenders commonly enforce more stringent needs contrasted to conventional fundings. To improve your opportunities of approval, start by inspecting your credit report and resolving any kind of concerns. A score of 700 or higher is usually liked, as it demonstrates creditworthiness.

Following, gather your financial documentation, including income tax return, W-2s, and financial institution statements. Lenders typically require thorough proof of income and assets to evaluate your ability to repay the loan. Preserving a reduced debt-to-income (DTI) proportion is also crucial; go for a DTI listed below 43% to enhance your application's competitiveness.

Additionally, take into consideration making a bigger deposit. Lots of loan providers seek a minimum of 20% down for big car loans, which not only reduces your funding amount but additionally signals monetary stability. Engaging with a knowledgeable Check This Out home mortgage broker can offer important understandings into the procedure and aid you navigate numerous lender alternatives.

Conclusion

In recap, big financings existing considerable advantages for homebuyers looking for homes that surpass conventional lending limits. Complete understanding of both the demands and advantages connected with jumbo fundings is vital for making informed home acquisition decisions in a competitive real estate market.

The interest prices on jumbo fundings may be a little higher than those on adhering loans, mirroring the raised threat More Help for lenders.

While a conventional funding may call for a down repayment of as little as 3% to 5%, big finances typically demand a minimum of 10% to 20%.

Rate of interest prices on jumbo financings may vary from those of conventional fundings, typically being somewhat greater due to the raised threat lenders presume.Safeguarding a jumbo finance needs mindful planning and prep work, as lending institutions typically impose stricter demands contrasted to conventional car loans. Many loan providers look for at the very least 20% down for jumbo car loans, which not only minimizes your car loan quantity yet also signals monetary stability.